First off, I need to start off saying that I love “big idea” people. You know, those friends you have that come up with some of the best small business ideas, designs, or products that can make our lives easy.

But some of those people never get to the “let’s fully think this out” stage, much less develop a solid small business plan and sometimes, we watch their ideas crumble. And if we are really being honest, some of those people might even be us and it really was an amazing idea.

Wait, you mean I really need a plan to make this work?

Far be it for me to tell you that successful small businesses have not come together quickly without a huge book of a business plan because well, that really isn’t true.

What is true is that most of those businesses either developed so much on the back of a napkin at the dinner or. started piecing it together quickly as they were going so, they had a higher success rate by continuing to work things through before they encountered them.

A plan by definition is a “detailed proposal of doing or achieving something”. What I really love is the second definition, “an intention or decision about what one is going to do”.

All a small business plan is can be defined as a detailed listing of your intentions for what you are going to do and how you are going to do it, covering the good things (customer growth, sales, marketing) and the not-so-good things (loss of sales, expenses, legal obligations).

Why are you always bringing up the negative?

So we mentioned the not-so-great things about business ownership. These are the issues that cause more business to fail and many of these items could have been prevented with a bit of business planning.

Things like: holding money back for taxes, paying penalties when you don’t pay taxes, longer-term capital needed for inventory purchases, paying for unexpected services, legal fees, etc.

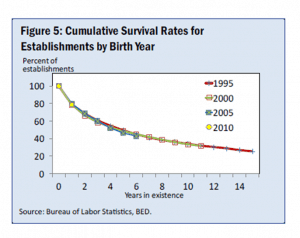

We can go on and on about many things that bring small business owners to their knees. Ultimately, about 50% of small business owners will not make it past 5 years, according to the Small Business Association, and those are rates no one wants to think about.

But how do you get around that and have a strong business that is prepared for the “ups and downs” of small business life?

A plan to develop a plan

Developing a business plan takes time, usually time people want to take in developing certain elements of their business but, the great thing is, they can add the stuff they love to the plan, they just have to add the stuff they don’t love too.

While there are not a lot of governmental things that I recommend, one that I strongly recommend is the Small Business Administration’s business plan documents.

This is a great step-by-step document to walk you through the process. It has video tutorials (for those that can’t sit and read for a long time or want to listen while driving to work) and it also allows you to enter your information little by little.

You can take a year or a day to put everything in and it will produce a great business plan document (as long as you put everything in it). This tool has articles and blogs as well as a Find Resources feature that helps you find local support in your area.

Lastly, if a possible 50% average fail rate is not enough to encourage you to do everything you can to play through all the possibilities with your small business, there are many benefits to having a well thought out and detailed business plan.

Things like bank loans, small business grants, small business competitions, private loans, or getting consulting services are all items that require good business plans to ultimately help your business develop and grow with long term success.

Thanks for reading and if you liked this blog, make sure to share it on your favorite social media page.

The Type 3 guy, The Type A girl and never ending typing: Our small business journey

The Type 3 guy, The Type A girl and never ending typing: Our small business journey

Leave a Reply